If you live in a homeowners association (HOA), you know that maintenance fees aren’t the only costs associated with multi-family living. Depending on how a community plans for capital replacements and how well-funded the reserve funds are, special assessments (also known as special levies in Canada) can range from hundreds to hundreds of thousands of dollars, and they may be assigned to each homeowner. Eli Report introduces a crucial tool for owners: a special assessment forecast for condo and HOA members.

What exactly does Eli Report show?

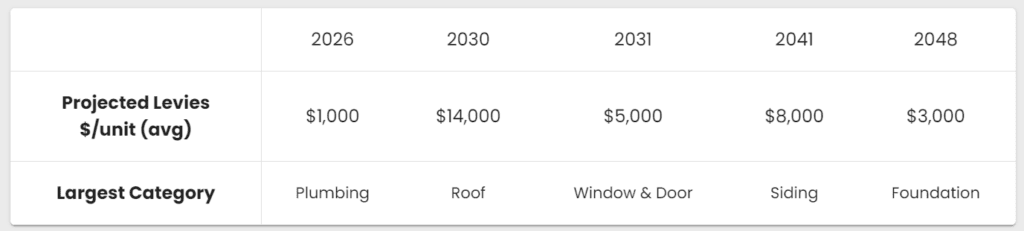

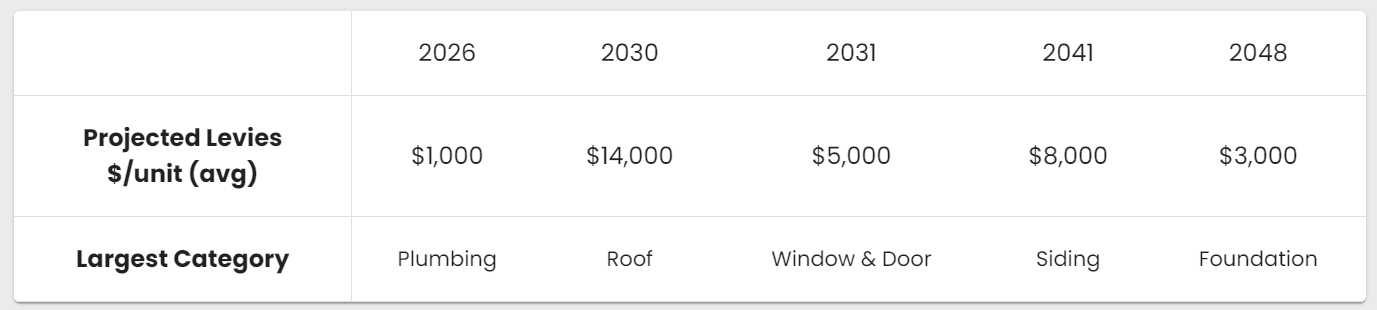

Eli Report projects the timing, amounts, and primary expenditures for special assessments in your community, shown as an average per unit. Depending on the nature of upcoming repairs or replacements, the report may look like this:

This HOA has significant upcoming expenditures and insufficient funds in its reserve account. It’s important to note that special assessments over several years are not uncommon for multi-family communities.

What does this mean for me?

As a condo or HOA homeowner, these projections provide an estimate of the additional costs you may be asked to pay in any given year, beyond your regular HOA dues. While this is only a forecast, it helps prepare you for potential financial exposure due to maintaining common areas and shared property.

How does Eli Report justify this projection?

Eli Report does not provide advice or opinions; rather, it derives data from reliable sources. Key inputs include:

- Reserve Study or Depreciation Report

- This document, written by a professional engineer, should be updated every 3-5 years. Eli Report uses projected expenditures from this report, adjusting for inflation where necessary.

- Reserve Fund Balance

- The balance of the HOA’s reserve fund is sourced from financial statements or equivalent documents. If unavailable, Eli Report assumes a $0 reserve balance, potentially overstating the initial special assessment.

- Annual Reserve Contributions

- While reserve studies often propose various funding options for repairs, Eli Report uses the most recent budgeted contributions to estimate future reserve fund levels. If this figure is unusually high or low, the projected special assessments could be inaccurate.

Why might the projections be inaccurate?

Several factors could lead to discrepancies, including but not limited to:

- An outdated reserve study or only partial data (e.g., sectioned HOAs with different budgets)

- Delayed capital replacements that don’t follow the engineer’s schedule

- Rising inflation increasing costs beyond what was estimated in the reserve study

- The HOA choosing to raise or lower reserve fund contributions unexpectedly

- A special assessment that raises more or fewer funds than anticipated

- Errors in data extraction or interpretation

- A natural disaster or emergency requiring sudden capital expenditures

- Inaccurate building information (e.g., the wrong number of units), which may lead to incorrect per-unit assessments

- Special assessment estimates based on the average across units, so larger units like penthouses will likely have higher fees, while smaller units will have lower fees

Final Thoughts

Eli Report is designed to give you a solid understanding of your potential financial exposure to special assessments. However, it’s important to always review the underlying documents, such as reserve studies, budgets, and financial reports, to get the full picture. Eli Report assumes no liability for inaccuracies in the collection or display of data.

If you are a Realtor, homeowner, or buyer in a multi-family community, sign up now and get a free Eli Report.