If you live in a strata, you know that maintenance fees aren’t the only possible cost associated with multi-family living. Depending on the way a community plans for capital replacements, and how well-funded their contingency reserves are, special levies (aka special assessments) amounting from hundreds of dollars to hundreds of thousands of dollars can be assigned to each owner. Eli Report is introducing the most significant tool for owners yet: a special levy forecast for condo and strata owners.

What exactly does Eli Report show?

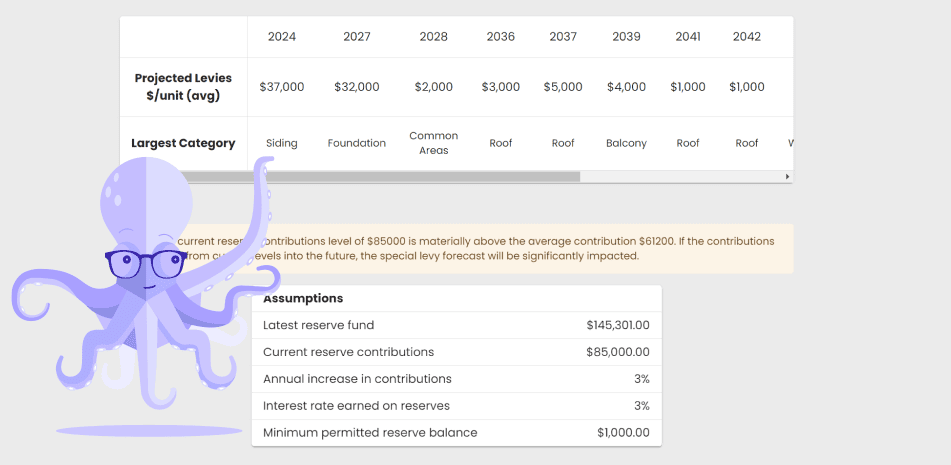

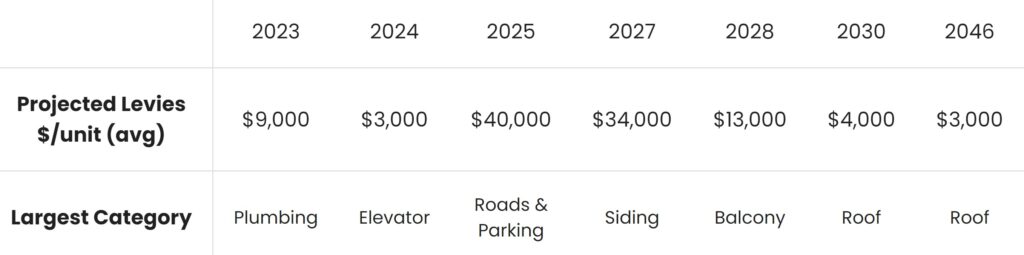

We project the timing, amount and primary expenditure for special levies in your communities, shown on a dollar per unit basis (average). Depending on the nature of work being done, it may look like this:

This strata has some significant upcoming expenditures and not enough in its contingency reserve fund. As anyone living in a multi-family community should know, having several special levies over the span of a few years does happen.

What does this mean to me?

As an owner in a condo/strata, these figures are an approximation of the amount you may be asked to pay in a given year above-and-beyond your strata’s maintenance fees. While it is only a forecast, it should help you understand the likely best-case scenario (in life, things tend to cost more and take longer than expected) as far as financial exposure to maintaining the health of your common property.

How will Eli Report justify this projection?

We do not provide any advice or opinions, so what is shown in this table will be derived from the data made available to us. These are the critical inputs:

1) Depreciation Report or Reserve Study

This document is written by a professional engineer and should be updated at least every 3-5 years. We use the projected expenditures estimated by the professional engineering company, which are adjusted for inflation on their assumptions.

2) CRF or Reserve Fund balance

We are provided with this figure on either financial statements or a Form B ‘information certificate’. If unavailable, our system will believe the CRF (contingency reserve fund) balance is $0 and overstate the amount of the first special levy accordingly.

3) Annual budget CRF or reserve contributions

While the depreciation report provides several funding scenarios for the repair and replacement of capital items, it is our view that a reasonable predictor of future CRF contributions are the current annual budget CRF contributions. If this number is anomalously low or high in the latest budget available to us, projected special levies could be off materially.

Why might it go wrong?

There are many reasons our projections could be inaccurate, including but not limited to:

- being supplied with an outdated depreciation report, or only one depreciation report when there are more (sectioned stratas, amenity buildings, etc)

- capital replacement not happening on the schedule prepared by the engineering company in the latest available depreciation report

- inflation meaning that costs are higher (or lower) than estimated by the engineering company in the latest available depreciation report

- a condo or strata choosing to increase (or decrease) the rate of CRF contributions

- the latest budget CRF contributions not being reflective of a typical budget year

- the latest CRF balance excluding funds set aside for capital projects (we can display the forecast with total reserve funds)

- a strata earning more or less on their CRF balances

- a larger or smaller special levy being raised by the strata, meaning that they have more or less funds at a given point in the future

- bad data from extraction, or human error from a failure to accurately review that data, especially when it comes to tables that may not have inflated costs or that exclude taxes and/or contingency

- sectioned stratas having more than one depreciation report or budget, which may cause us to present a partial picture

- a natural disaster, catastrophe, act of terrorism or otherwise that accelerates near-term capital expenditures

- inaccurate building information (such as the number of units) may cause us to under or over-state the levies on a per unit basis

- the average presented is based on the number of units, not a specific unit or entitlement, so if you own a penthouse your levies will be relatively higher, and if you own a studio your levies will be relatively lower.

As a result, while this tool is designed to give you at least a good sense of exposure to special levies, it is important to always read the underlying documents. Eli Report assumes no liability for any inaccuracies in the collection, presentation or display of data.

If you are a Realtor, owner or buyer into a multi-family community, sign up and get a free Eli Report.