December 15, 2020

It has been just over a year since Eli Report first began seeing significant increases in strata corporation insurance premiums. In June, we reported that insurance premium budgets were up 65% year-to-date in 2020, and this trend has held true as we close out the calendar year.

We will be watching closely as insurance renewals continue over the coming months, and it will be interesting to see if premium budgets will rise, level off or fall compared to the past year. An insurance policy has many moving parts, and we have seen a significant shift in coverages as they relate to deductibles, replacement values, extended rates and maximum loss limits. If your strata council would like their current insurance policy benchmarked against the market, get in touch by emailing us here.

And while it is now no secret that rates are up significantly, how strata corporations have adapted their finances to fund these additional costs is worth a closer look. Overall, our data shows a number of funding methods have been used, some of which may be cause for concern:

- Increased overall strata fees. For the most part, strata corporations have budgeted for increased strata fees in 2020-2021, recognizing that insurance is an operating cost.

- Maintained overall strata fees, while increasing their insurance budget. In these cases, we have seen a number of communities reallocate funds away from certain areas to pay for increased insurance costs. Most commonly, reserve contributions and repair & maintenance spend is being decreased to allow for minimal or no strata fee increase, which is not sustainable.

- Special levies & CRF Loans. For many strata corporations that experienced an insurance renewal in the middle of their operating year, they had to resort to either raising funds by special levy or taking a loan from their cash reserve fund to pay for their insurance premiums. As insurance is an annual operating cost for a strata corporation, it would be problematic to see this type of funding over multiple years. Indeed, we have seen some strata corporations raise funds via special levy to cover next year’s insurance premiums as well. If insurance premiums remain high a shift to strata fees will be in order.

- Monthly financing from the broker. Some strata corporations, perhaps unable to borrow money from their cash reserve fund, were able to secure monthly financing from their insurance broker. This method of paying annual insurance premiums has been available to strata corporations before the current insurance crisis, and financing rates are usually between 3.0% and 7.0% according to our data. Over the past year, a number of strata corporations were even able to secure interest-free financing from their brokers.

- No coverage at all. While rare, we have seen a small number of strata corporations that have been unable to obtain coverage for a specified period of time, or for certain risk areas. Examples of this are shown when a gap in coverage exists, usually around 30 days, between a previous years’ policy expiring and the renewed policy coming into force. We have had discussions with some strata council members that indicate they were not able to obtain coverage until certain loss mitigation devices, like automatic water shut off valves and leak detection systems, were installed. There is also evidence that some strata corporations currently do not maintain specific coverage, like earthquake, at all. Examples of these cases seem very rare, however.

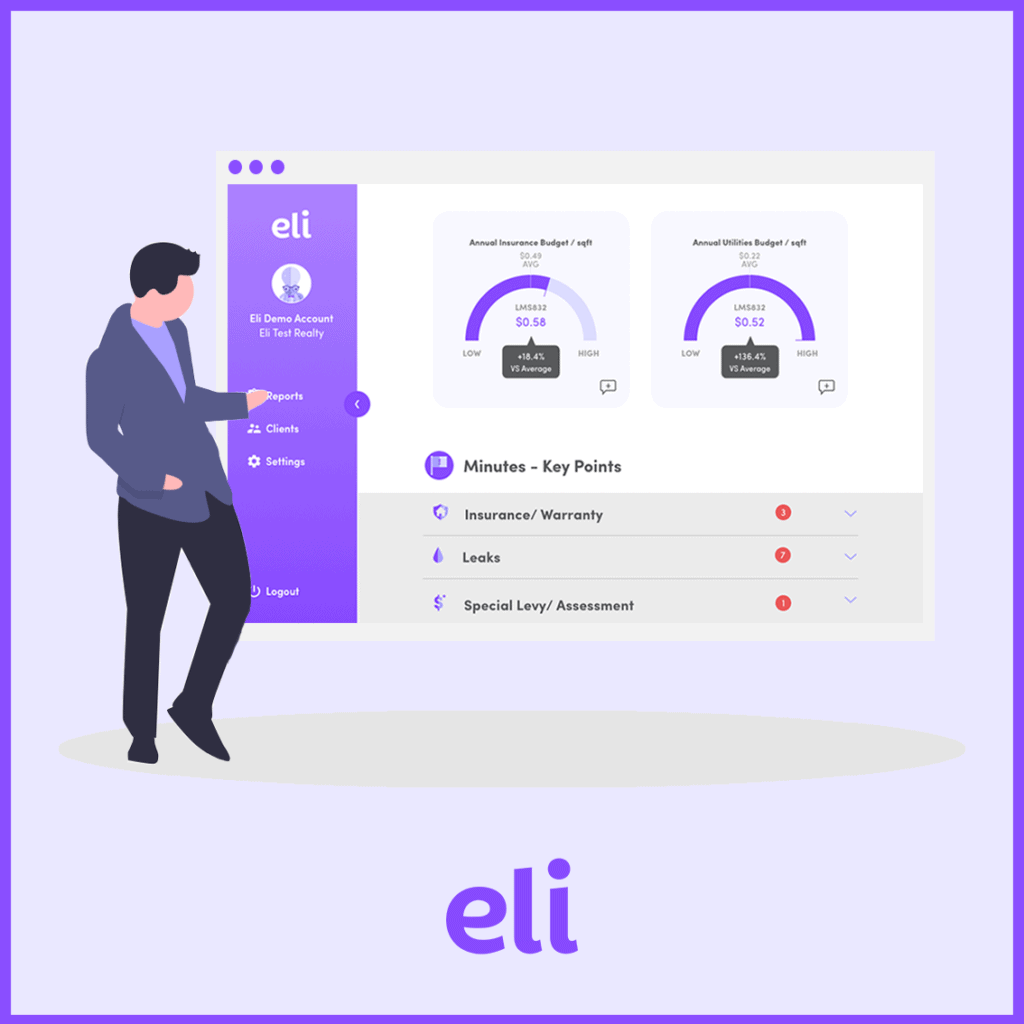

It has been a tough year for strata corporations on the insurance front, and there is no indication in our data and investigations that insurance premiums will fall back to previous levels over the next 12 months. At Eli Report, we can objectively help current owners and strata councils understand how their budget and insurance policy compares to the overall market.

As an owner or member of your strata council, sign up here to obtain a free Eli Report.

As a prospective buyer performing due diligence on a strata community, you can always get a free Eli Report from your realtor.