Thinking of purchasing a home within a Homeowners Association (HOA) community?

While HOAs can be daunting, your dream property may be managed under an HOA. If you’re thinking about placing an offer for a home, it’s very important to review the HOA documents in detail, and know what to look for.

These documents provide vital information about the community’s rules, financial health, and potential costs for buyers.

By the end of this guide, you’ll understand the key HOA documents needed for closing, why they are important, and other insights to navigate the HOA document review process.

Key Highlights

- HOA documents are important for understanding community rules, financial obligations, and potential restrictions.

- Reviewing these documents can prevent future surprises related to fees, assessments, and regulations.

- Common HOA documents include CC&Rs, bylaws, financial statements, and reserve studies.

- Challenges in obtaining HOA documents can lead to closing delays and complications.

- Eli Report simplifies the document review process, making it efficient and clear for buyers and agents.

Potential Issues with HOA Documents at Closing

It’s important we review the potential issues with HOA documents that can happen near or at closing.

That way, you’re fully prepared for the worst and can easily navigate through with your Realtor.

Here are the most common HOA document issues at closing:

- Incomplete or Outdated Information: HOAs may provide outdated or incomplete documents, leading to misunderstandings about current rules or financial status.

- Delays in Document Retrieval: Some HOAs have lengthy processes for preparing and authenticating records, which can slow down the closing timeline.

- Hidden Requirements: Buyers may discover unexpected HOA requirements that affect their planned use of the property.

- Complex Language: HOA documents often contain legal jargon that can be difficult for the average buyer to interpret.

- Undisclosed Assessments: Special assessments or upcoming major expenses may not be clearly communicated in initial document reviews.

Real Life Example

Consider a scenario where a buyer purchases into an HOA, after 5 months in their newly beloved home, HOA fees jump significantly.

A similar situation happened to owners in Las Vegas. Now these homeowners are faced with rising cost situations that they may not be able to meet on an on-going basis.

Key HOA Documents Needed for Closing

Below are the main key documents you should spend time reviewing and what exactly you should look out for, so you don’t miss important numbers and potential obligations.

Keep in mind that doing a detailed and manual review of HOA documents can take anywhere from 2 to 6 hours, depending on many different factors.

Pro Tip: Use Eli Report to review HOA Documents with AI in minutes. Run a Report and Test it Out Today.

Covenants, Conditions, and Restrictions (CC&Rs)

The CC&Rs are basically the rules for living in a neighborhood with an HOA. It’s a legally binding document that outlines the rights and obligations of property owners.

What It Covers:

- Property use restrictions;

- Architectural guidelines and approval processes;

- Maintenance responsibilities (both individual and HOA);

- Common area usage rules;

- Enforcement procedures and potential penalties.

Why It Matters:

CC&Rs directly influence how you can use and modify your property for your enjoyment or other usages.

They also explain how the neighborhood’s shared areas, like pools or parks, are taken care of. Ultimately, these rules help keep the neighborhood looking nice and fair for everyone.

Without this document, you may not know your obligations as a homeowner and potential limitations on your property rights.

And violating CC&Rs can result in fines or legal action, which is why you want to make sure you’re ok with the property use restrictions, maintenance responsibilities, etc.

HOA Meeting Minutes

The HOA Meeting minutes are official records of discussions, decisions, and votes taken during each HOA board meeting. They provide a historical record of the association’s activities and concerns.

What to Look For:

- Recent major decisions or policy changes;

- Ongoing disputes or legal issues;

- Planned community improvements or repairs;

- Discussions about fee changes, budget changes, or special assessments.

Why It Matters:

Reviewing recent meeting minutes can alert you to potential issues or upcoming changes that might affect your decision to purchase.

By reading the minutes, you can stay updated on how the HOA is managing, how fees are being used, and if there are any new rules or big projects planned.

Financial Statements and Budgets

The budget is a plan for how the HOA will spend and save money during the year. It lists things like paying for lawn care, fixing roads, or keeping the pool clean.

The financial statements show how much money the HOA actually has, what it spent, and what it earned (like from HOA fees). These reports help homeowners see if the HOA is spending money wisely and saving enough for big repairs in the future.

What to Look For:

- Income statements: Review revenue sources and major expense categories;

- Balance sheets: Assess the HOA’s overall financial position;

- Annual budgets: Understand planned expenses and how dues are allocated;

- Reserve fund status: Check if adequate funds are set aside for future major repairs.

Why It Matters:

Financial documents help you assess the HOA’s fiscal responsibility and stability. A well-managed HOA with healthy finances is less likely to impose sudden, large assessments on homeowners.

Recommended Reading: What do HOA fees cover?

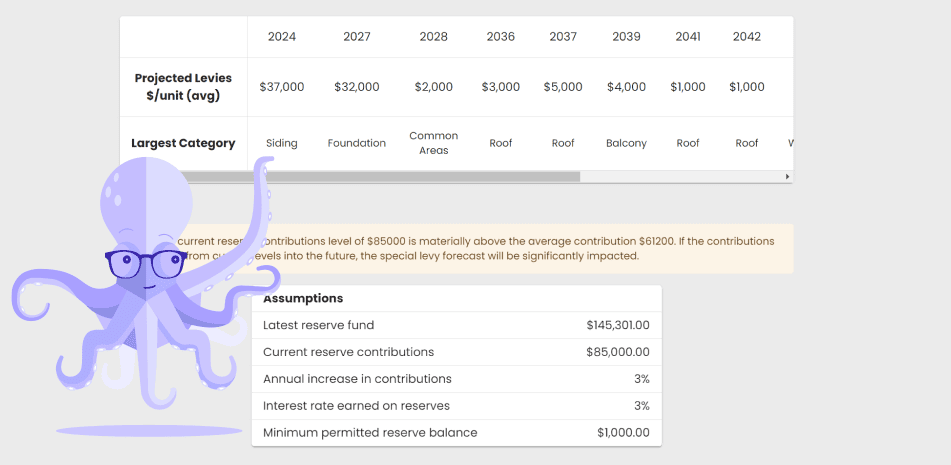

Reserve Study Report

An HOA reserve study is a long-term capital budget planning tool that identifies the current status of the reserve fund and establishes a stable and equitable funding plan to offset anticipated future major common area expenditures.

What to Look For:

- Fully-funded reserve fund

- Inventory of major components the HOA is responsible for maintaining;

- Estimated remaining useful life of these components;

- Projected replacement or repair costs;

- Recommended annual reserve contributions to meet future needs.

Why It Matters:

The reserve study is crucial for assessing potential future expenses and the likelihood of special assessments. An underfunded reserve can lead to deferred maintenance or unexpected financial burdens on homeowners. Assess the financial health of the HOA before buying.

HOA Bylaws

The HOA Bylaws document establishes the operational structure and governance rules for the HOA. It explains how the people in charge (the HOA board) are chosen, what they do, and how they make decisions for the neighborhood.

What it Covers:

- Board member roles and responsibilities;

- Election procedures for board members;

- Meeting frequency and protocols;

- Voting rights and procedures for homeowners;

- Amendment processes for HOA rules.

Why It Matters:

Understanding bylaws helps you gauge your ability to participate in and influence HOA decisions. They provide insight into how conflicts are resolved and how you can voice concerns or propose changes within the community.

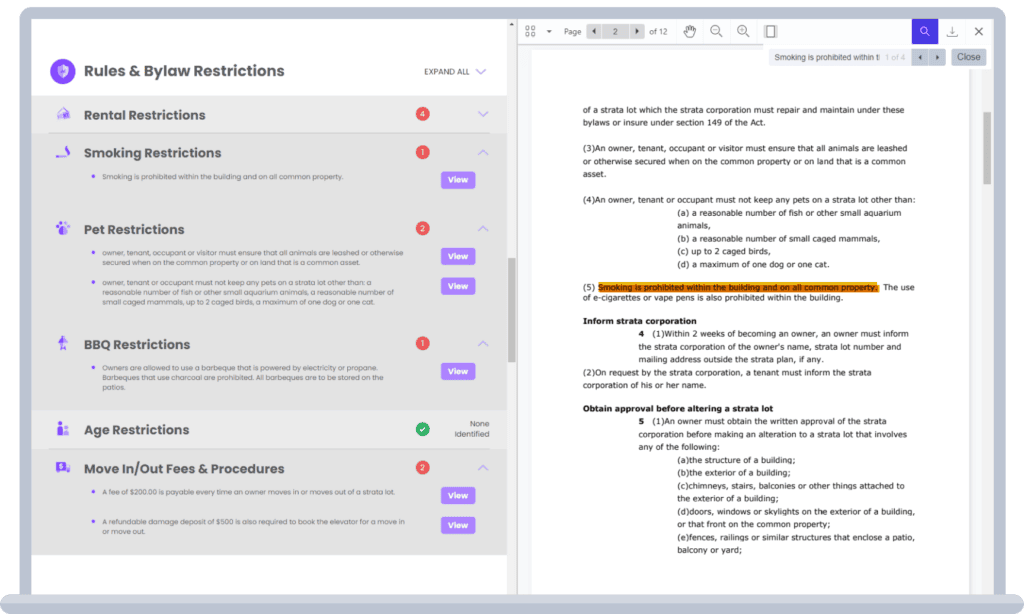

Rules and Regulations

This document details specific community rules that govern day-to-day living within the HOA. While it sounds very similar to the CC&Rs document, it’s often an expansion on broader guidelines for the HOA community.

Common Areas Covered:

- Pet policies (breed restrictions, leash rules);

- Parking regulations;

- Noise restrictions;

- Trash and recycling procedures;

- Pool and common area usage rules;

- Holiday decoration guidelines;

- Rental restrictions (if applicable).

Why It Matters:

Rules and regulations directly impact your daily life in the community. Make sure your lifestyle aligns with the rules that’s laid out in these documents. Foregoing this step could create additional fines and headaches for yourself.

Insurance Certificate

The insurance certificate outlines the HOA’s insurance coverage, which typically includes property and liability insurance for common areas.

Common Areas Covered:

- Types of coverage (e.g., property damage, general liability, directors and officers liability);

- Coverage limits and deductibles;

- Areas or incidents covered vs. homeowner responsibility.

Why It Matters:

Understanding HOA insurance coverage helps you determine what additional personal insurance you might need. It’s crucial for protecting your investment and understanding your potential liability in various scenarios. It will also help you understand if there may be upcoming insurance premium increases.

Why is this review important?

By thoroughly reviewing these key documents, potential buyers can gain a comprehensive understanding of their rights, responsibilities, and potential costs associated with living in the HOA community. This knowledge is invaluable for making an informed decision and avoiding unexpected issues after purchase.

Recommended Reading: Can I Refuse to Join an HOA?

Understanding Special Assessments and Fees

Special assessments are additional fees homeowners may need to pay for unforeseen expenses or improvements not covered by regular dues.

It’s essential to understand any upcoming special assessments, as they can impact a property’s cost of ownership. There are countless horror stories of special assessments for HOAs completely taking people by surprise.

By reviewing recent assessments and future financial plans, buyers can determine if they are comfortable with the HOA’s dues and policies.

Pro Tip: Use Eli Report’s Special Levy Forecast tool to find out if there will be future special assessments and levies to worry about.

How to Review Complicated HOA Documents in Minutes, Not Hours

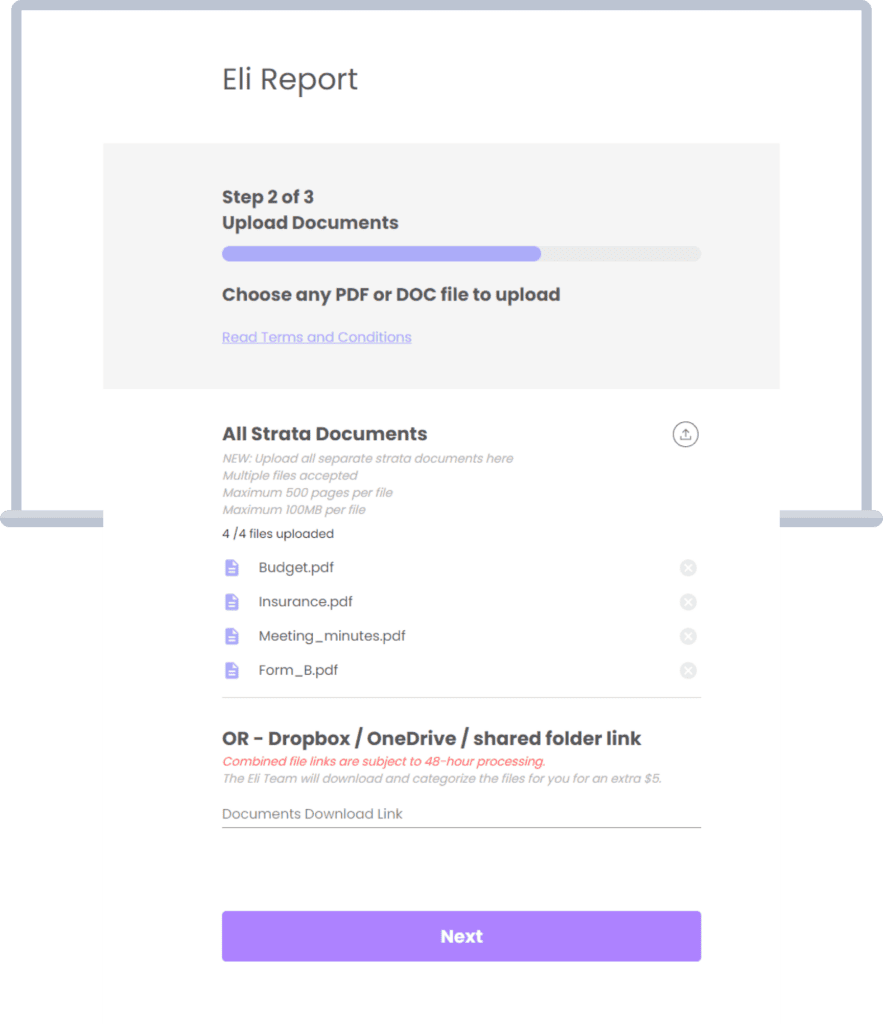

Eli Report streamlines the review process, helping buyers, agents, and property managers quickly access important insights from HOA documents. Here’s how it works:

Step 1: Choose the HOA Files to Upload

Select relevant files like CC&Rs, bylaws, financial statements, and reserve studies for upload.

Step 2: Let Eli Run

Eli Report processes the documents, extracting key information.

Step 3: Review Your Report and Summarizations of Important Info

Receive a concise report highlighting essential details and potential issues.

Common Challenges and FAQs

Who pays for HOA documents?

Typically, the buyer or their agent is responsible for obtaining and paying for HOA documents. In some instances, there will be copies readily available from the seller’s agent.

Is it required to review HOA documents before buying?

While not legally required in all cases, reviewing HOA documents is strongly recommended to avoid unexpected issues after purchase. After all, the last thing you want as a home buyer is to get stuck with a huge special assessment and be forced to sell.

What if the HOA is unresponsive in providing documents?

If you’re not able to get the important HOA documents you need, the next step is to work with your agent or attorney to escalate the request. In some cases, you may need to contact the HOA board directly.

Can HOA rules change after I purchase the property?

Yes, HOA rules can be amended through proper procedures outlined in the bylaws. This is typically done through the HOA Board and HOA meetings, any recent changes will be reflected in meeting minutes you can review.

Final Thoughts

Remember, an HOA can significantly impact your living experience and property value.

While the task may seem daunting, HOA Document Review tools like Eli Report can simplify the process, helping you make an informed decision.

Take the time to review these documents carefully or seek professional assistance to interpret complex terms.

And be sure to speed up your document review process with Eli Report. Run a free report today.